Venture Capital (VC) has become a hot topic in the world of business and startups due to its potential to transform ideas into successful businesses. In this guide, we'll dive deep into the world of Venture Capital, from understanding what it is and how it works, to making your way through the Venture Capital funding process.

What is Venture Capital?

Venture Capital is a type of private equity investment, where investors provide funding to startups and small businesses that they believe have high growth potential. In exchange for their investment, Venture Capitalists (VCs) usually receive equity, or ownership shares, in the company.

How does Venture Capital work?

Venture Capital funding typically comes from well-off investors, investment banks, and other financial institutions. The process is usually as follows:

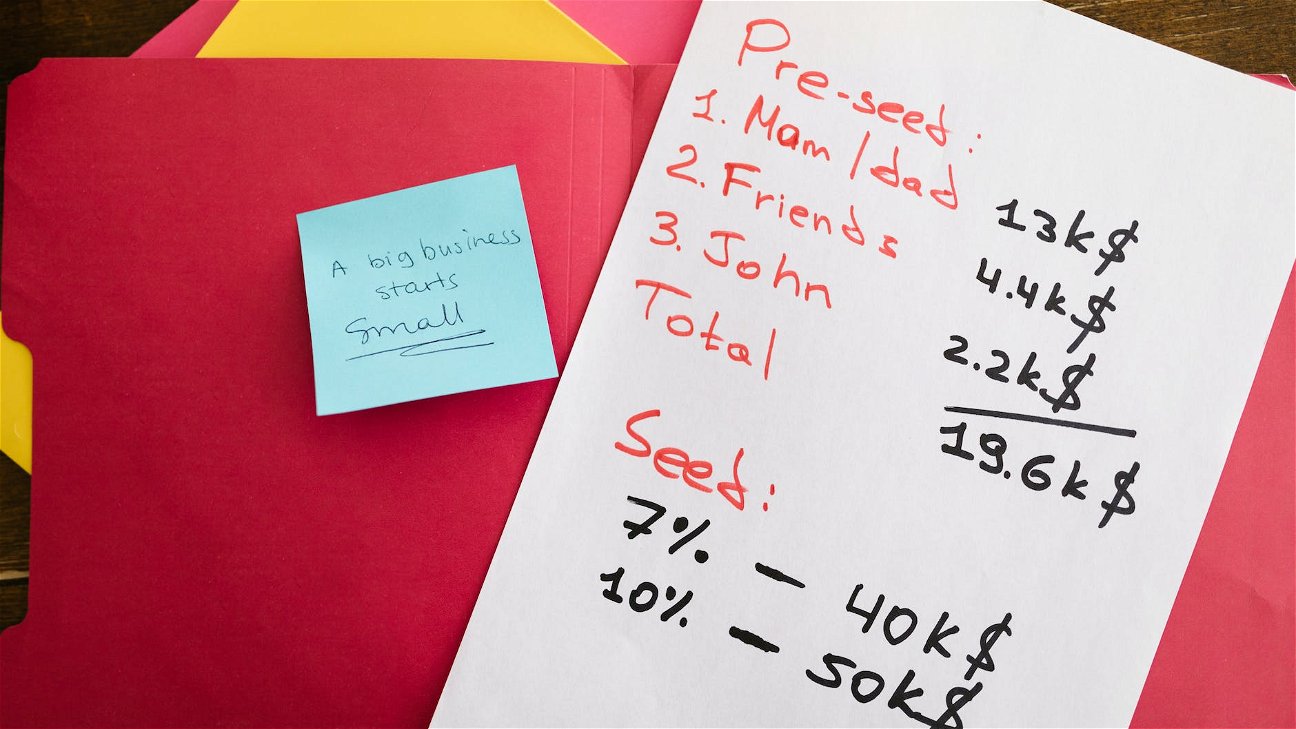

- Seed stage: This is the initial stage where the investment helps the company to develop its product prototype and carry out market research.

- Early stage: At this stage, the company has a clear business plan and the product is launched in the market.

- Expansion stage: The company is performing well in the market and needs funding to expand its reach.

- Later stage: The company is well established, profitable and is looking to go public or get acquired.

Benefits of Venture Capital

Venture Capital can offer numerous benefits to startups and small businesses:

- Access to capital: Startups often lack the necessary funds to grow and expand. Venture Capital can provide this much-needed capital.

- Mentorship and expertise: VCs often offer valuable advice and guidance, as well as access to their network of contacts.

- Credibility: Having Venture Capital backing can increase a startup's credibility in the market.

Risks involved in Venture Capital

However, Venture Capital does come with its risks:

- Loss of control: As VCs own a share of your company, they also have a say in decision-making.

- High pressure for returns: VCs expect high returns on their investment. This can put a lot of pressure on the startup.

- Risk of failure: Not all Venture Capital investments are successful. If the startup fails, investors lose their money.

How to approach Venture Capitalists

Knowing how to approach VCs is crucial to secure funding. Here are a few tips:

- Do your research: Know who you are pitching to. Understand what type of startups they invest in and what they look for in a company.

- Have a solid business plan: Your business plan should clearly outline your business model, target market, and projected financials.

- Be prepared for tough questions: VCs will want to know everything about your business. Be prepared to answer tough questions about your competition, financial projections, and exit strategy.